QuickBooks is an excellent choice of accounting software for small companies and smaller business entities. Being a QuickBooks Certified Bookkeeper, one can help businesses with setup, configurations, and management of their data in QuickBooks. If you have prior experience in bookkeeping and seek to progress in your employment, QuickBooks certification can assist you.

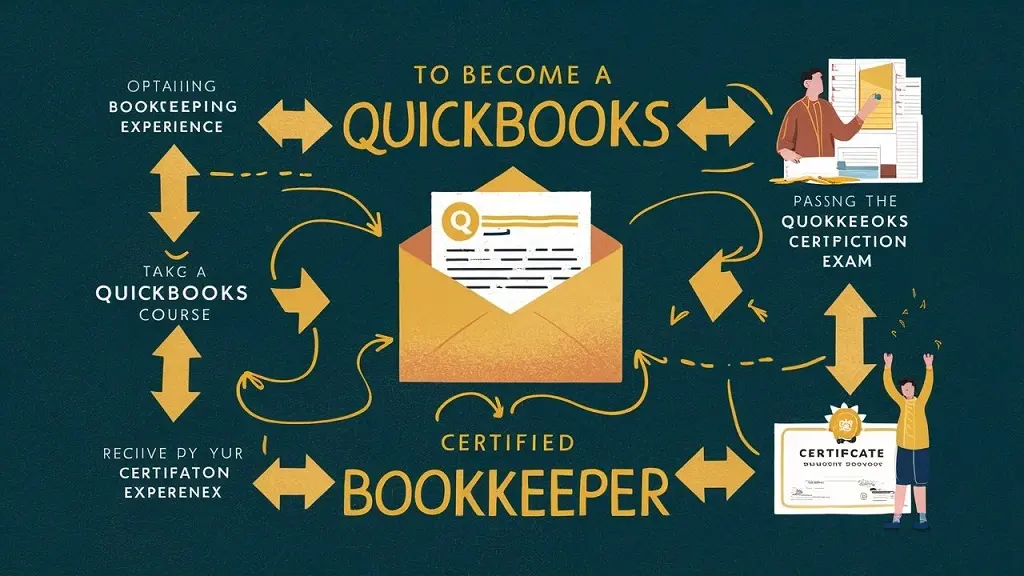

Here is an overview of the steps and requirements to become a certified QuickBooks bookkeeper:

1. Get Basic Bookkeeping Experience

Although not mandatory for obtaining the certification, prior experience in bookkeeping would help in mastering the QuickBooks software and performing the duties of a certified ProAdvisor. Try to get at least 1 year of hands-on experience in general bookkeeping tasks like:

- Recording transactions

- Reconciling accounts

- Preparing financial statements

- Processing payroll

Commonly, any accounting clerks, full-charge bookkeepers, or self-employed bookkeepers obtain qualifying bookkeeping experience.

2. Learn QuickBooks Software

Second, begin to get very comfortable with QuickBooks desktop products such as Pro, Premier, and Enterprise. Go through the user manuals and guides to understand critical aspects like:

- Creating a company file

- Recording common transactions

- Processing payroll

- Generating financial reports

Use the software to practice entering transactions for other types of small businesses to become familiar with QuickBooks’ flow and capabilities. Courses taken online can also help improve skills in different areas.

3. QuickBooks Certification Program.

Intuit offers two levels of credentialing under its QuickBooks Certified User Program:

1. QuickBooks Certified User

2. QuickBooks Certified ProAdvisor

The ProAdvisor program is more demanding and is the most popular among users.

Once you decide which track you want to take for the exam, register online and get a voucher for the exam.

Make an appointment to take your examination from the Prometric Testing Center. Exam fees are from $99 to $299 depending on the level chosen by the student.

4. Exam preparation and pass

Try to spend approximately one to two months going through exam preparation manuals, and test yourself using practice tests. When you are set, attempt the exam you have been booked for. When it comes to the ProAdvisor exam, expect to experience ‘mock’ problem-solving situations, as well as what you would do in actual employment situations and what you would recommend to a small business client.

Passing the multi-choice test with a score of 80% or higher will certify you and having qualifying bookkeeping experience will unlock “Advanced” status.

5. Apply for QuickBooks Certification

Once you pass the exam, apply on Intuit’s website by:

- Enclosing your score report

- Including verification of 1+ years of bookkeeping experience

- The third issue that was highlighted entails the acceptance of the terms of use by Intuit.

The approval decision can take about 1 week once all documents have been submitted.

6. Maintain Your Certification

QuickBooks produces new versions of the software every year so knowledge needs to be refreshed. Certified pros must pass a recertification exam with at least 80% every 3 years; the exam focuses on new features and if the pros fail they can attend 3 continuing education courses from the ProAdvisor Training Portal.

Benefits of Getting Certified

Here are some major perks of having QuickBooks ProAdvisor credentials on your resume:

- Creates a vast employment potential helping firms with QuickBooks integration management

- 85% of ProAdvisors make more than $50k annually for less than 30 hrs a week

-Opportunity to be self-employed and work from the comfort of one’s home

- Availability of discounts for QuickBooks and practice tools

- Business mentorship opportunities

- Credibility to attract more and higher paying customers

Certification can be beneficial for small business bookkeepers interested in augmenting their career or establishing an independent consultancy practice focused on QuickBook's best practices, implementation, and recommendations.

Contact us here for Bookkeeping With Quickbooks Online now!

Get Help Fast!

My Accounts Consultant Helps Accounting & Bookkeeping Services help you save money, better understand your business and find the Accounts problems before they hurt you.